As Linear’s Definition Gets Muddier, It’s Time to Talk ‘Convergent TV’

Here’s a question for anyone in TV advertising: How do you categorize Amazon’s Thursday Night Football (TNF)? Is it streaming or linear? For that matter, when WWE Raw debuts on Netflix in 2025, will that be streaming or linear?

Many are quick to point to the way the content is delivered. Content on Amazon and Netflix arrives via an Internet connection, so it’s clearly streaming, right? I’d argue that almost everyone who watches even a few minutes of TNF or Raw watches it live, rather than on demand. So, although viewers access the content via a streaming platform, every viewer sees the same thing simultaneously via the linear feed. Therefore, both programs are (or should be) linear TV.

As more platforms built around on-demand streaming purchase live broadcast rights, the definitions of linear and streaming are less clear.

How did the lines get blurred?

Streaming TV was initially launched as on-demand viewing, which was the primary attraction point. Since then, platforms have added more live programming alongside the surging number of FAST Channels that mirror a linear feed onto a connected device.

With respect to live programming on CTV, the NFL Thursday Night Football and Sunday Ticket (on YouTube TV) are just the beginning. For example, the NBA’s current TV rights deal expires in 2025, which will set off an epic bidding war where the streaming platforms are expected to play a major role. The league has said that this next round of negotiations will “help shape the future of our league.” It will undoubtedly shape the future of the entire TV industry as it brings more live sports action to a broader audience of viewers via digital pipes (it’s worth noting here that Max began streaming NBA games live this year as well).

While the platforms jockey for the rights to deliver live sports, another quiet revolution is happening with free ad-support streaming TV (FAST) channels, of which there are more than 1,000 available in the U.S. Rather than deliver content on-demand, as is the norm with streaming, FAST channels present content live, on a schedule, complete with ads. The experience so closely mimics traditional TV that Nielsen went so far as to call FAST “linear TV’s comeback.” Even though the word “streaming” is prominently placed within the acronym, FAST is linear. Confused yet?

Clearing the waters

The combination of live TV and streaming platform delivery is not unexpected, but it is creating confusion across the market. For several years, the ad industry has used streaming and linear as its two buckets. Often, the place where the content originated established which bucket it belonged to. On-demand content on platforms like Hulu and Peacock was streaming. Anything that aired on schedule on broadcast or cable channels was linear.

FAST and live sports could still be classified based on their delivery platform, but doing so doesn’t capture the nuance advertisers need to understand when crafting their media plans. There is a big difference between buying inventory on live Thursday Night Football compared to the on-demand nature of Amazon Prime Video.

This is especially true with measurement. When an ad runs against Thursday Night Football, Amazon offers a very clear understanding of how many people tuned in and likely saw that ad, and the advertiser can measure their performance to determine their ROI. With the on-demand nature of other streaming content, advertisers need some sort of data passed back to them so that they can accurately measure performance and determine which channels are worthwhile investments.

Convergent TV

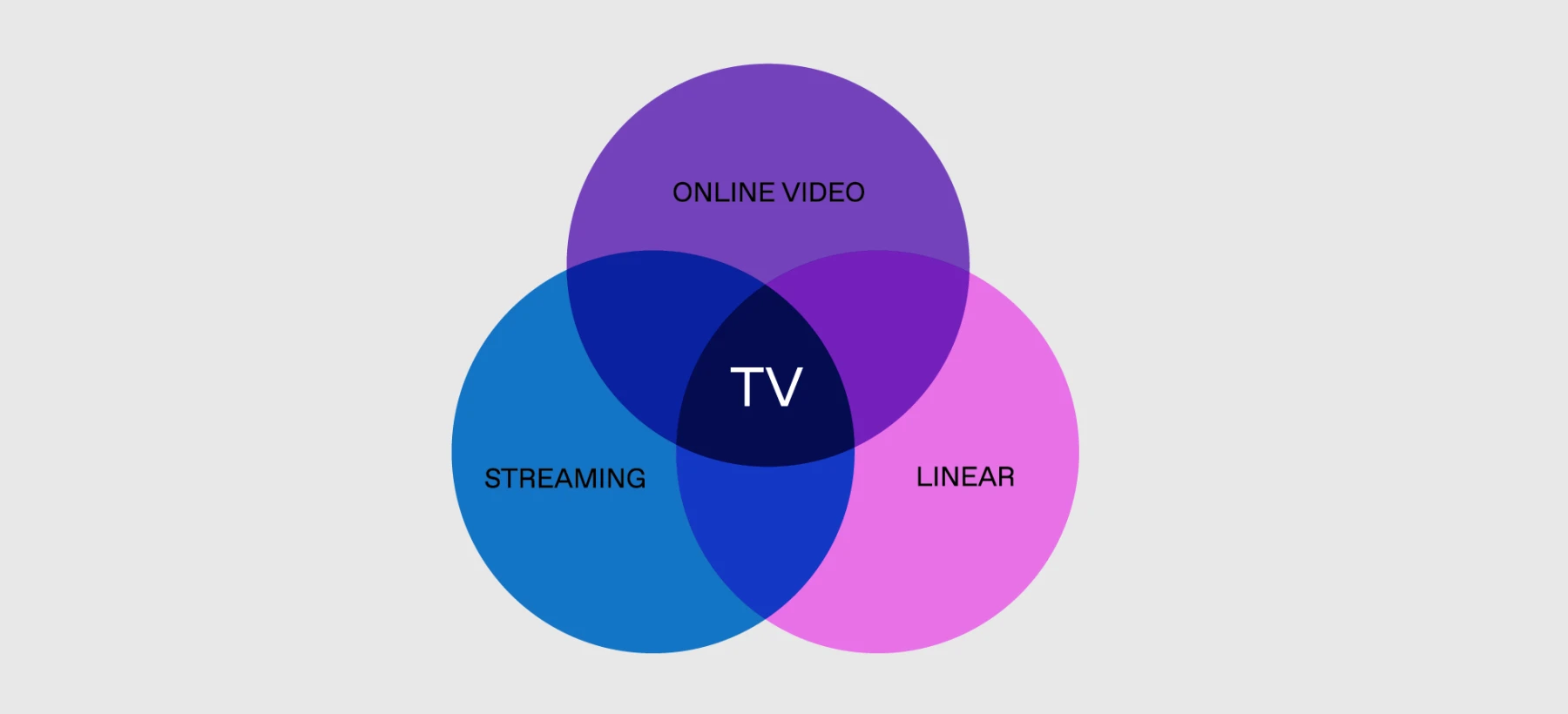

This blurring of lines should push the industry towards either a reclassification or no classification at all. Rather than streaming versus linear, it should simply be about convergent TV.

And when it comes to crafting TV campaigns that drive real business outcomes, brands should adopt a similar mindset and leverage convergent TV ads to unlock significant growth. Take our client, True Classic, for example, who used convergent TV advertising (linear, streaming, and online video) to reduce CPA (cost per acquisition) by 18% below their goal and drive a $2.95 CPV (cost per visitor) and 3x ROAS (return on ad spend).

As viewers become agnostic to how they watch the same content across different touchpoints, advertising should be treated the same in holistic campaigns (with the right measurement strategy for each). As demonstrated above, it’s no longer clear which experience belongs where, and advertisers are better off with a single categorization of convergent TV.

Philip Inghelbrecht

I'm CEO at Tatari. I love getting things done.

Related

How TV Became a Critical Acquisition Channel for Made In

We sat down with Made In at GROW LA to discuss how their brand leverages streaming and linear TV ads to build brand awareness and drive lower-funnel campaign results.

Read more

YouTube and TV: Tru Earth's Winning Combination

In this blog post, we'll share how Tru Earth layered YouTube into their TV campaign to increase website visits and drive conversions.

Read more

CTV stands for Convergent TV, not Connected TV (and what this really means for TV advertisers)

In this article, we will unpack OLV and most importantly, the relevance of OLV to the old definition of Connected TV (making for a new Convergent TV).

Read more