How to Save Cable TV

Charter Communications and Disney recently renewed their carriage agreement after their dispute resulted in Charter’s customers being unable to watch Disney’s key channels, especially ESPN, ahead of many must-see football games. Such carriage fee standoffs impacting renewals have become routine but with consequences that are not fully understood.

It is obvious that customers are hurt by the resulting higher subscription prices (as already evidenced by DISH Network and DIRECTV announcing price increases). Cable TV companies are losing approximately 15,000 subscribers daily in 2023. If this trend persists, the industry could lose more than 4 million customers for the year.

What is not apparent is that the adverse effects extend to MVPDs (Multichannel Video Programming Distributors) and networks, ultimately resulting in lower profits. Simply put, all parties are losers. This situation is likened to a well-known economic thought experiment: the Fishing Boat Paradox.

To better understand the problem, let's first break this issue down into simpler terms. We’ll then discuss its negative consequences and propose some solutions.

Understanding the MVPD Model

Carriage Fees: TV networks (i.e., Disney) charge MVPDs (cable companies, i.e., Charter) fees to carry their channels. These fees, known as “carriage fees,” can be substantial and directly impact the operational costs of MVPDs.

Higher Subscription Costs and Subscriber Attrition: MVPDs raise subscription fees for all customers to cover these carriage fees - even if a customer doesn’t watch a certain network. These higher subscription fees can provoke subscribers to seek more cost-effective alternatives or abandon TV services altogether, exacerbating cord-cutting.

Everyone loses, not just the subscribers: MVPDs earn less revenue owing to the higher attrition. Similarly, networks receive lower total carriage fees due to fewer subscribers for which carriage fees are paid, and they also receive lower income from ads due to resulting reduced impressions.

The agreement between Charter and Disney, as described in this Verge article (where Charter’s Spectrum cable and Disney’s streaming services are bundled into one package) has cascading consequences. While the article describes favorably the higher negotiated carriage fee as well as the bigger bundle, those benefits to Disney will likely be short-lived. While some viewers might find such a bigger package worth the cost, others will not. The expected increase in Disney’s fees may ultimately result in Charter’s subscriber attrition impacting all networks that run on Charter like HGTV and even Disney itself.

Analogous Scenario: The Fishing Boat Paradox

Imagine several boats fishing in one area. The more each boat owner invests, the more that investment in isolation would yield higher profits. But there is an externality in that the fish supply depletes, hurting other boat owners. Thus, if all boat owners make the same decision to invest, the end result is that all of them are worse off.

Let’s look at the fishing boat paradox In the context of MVPDs:

Carriage fees = Resources: High fees are like using lots of resources to catch fish.

Competition reduces resources: Just like aggressive fishing diminishes the fish population, higher fees decrease the number of viewers.

Shared impact and externalities: Each fisherman - or network’s decision- negatively impacts other parties.

Could Collaboration Be the Solution?

Economist Adam Smith argued collusion yields monopoly power and thus, higher prices. In response, governments have enacted antitrust laws that forbid price collusion and keep prices lower.

However, the MVPD dynamics present the exact opposite. If networks colluded to keep carriage fees low, subscribers would benefit from lower prices, and MVPDs and network profits could simultaneously increase.

A Way Forward

The issues within the MVPD model, with its escalating costs and declining viewer numbers, are remarkably similar to the Fishing Boat Paradox, where over-investment depletes shared resources. If networks could collaborate on pricing, they might collectively enhance market conditions, benefiting viewers and businesses alike.

Here are some possible solutions:

Allowing Controlled Collusion: Antitrust laws could be adjusted to permit collaborations in specific situations.

Ala Carte Pricing: Viewers pay only for the channels they watch.

Hybrid Models: Offering an “ala carte” option with a slight premium on channel pricing relative to the package discount price.

Tiered Discounts: Encouraging viewers to select more channels by offering progressive discounts, which again would allow subscribers to opt out.

Metered Pricing: Billing based on the channels chosen and viewing time.

Through these means, MVPDs and networks might navigate the present market dilemmas, crafting a more balanced and sustainable model for content distribution. This potential for cooperative strategies might just steer the industry towards fairer winds, aligning viewer satisfaction with business profitability.

Joel Lander

I’m head of strategy and I have lots of ideas.

Related

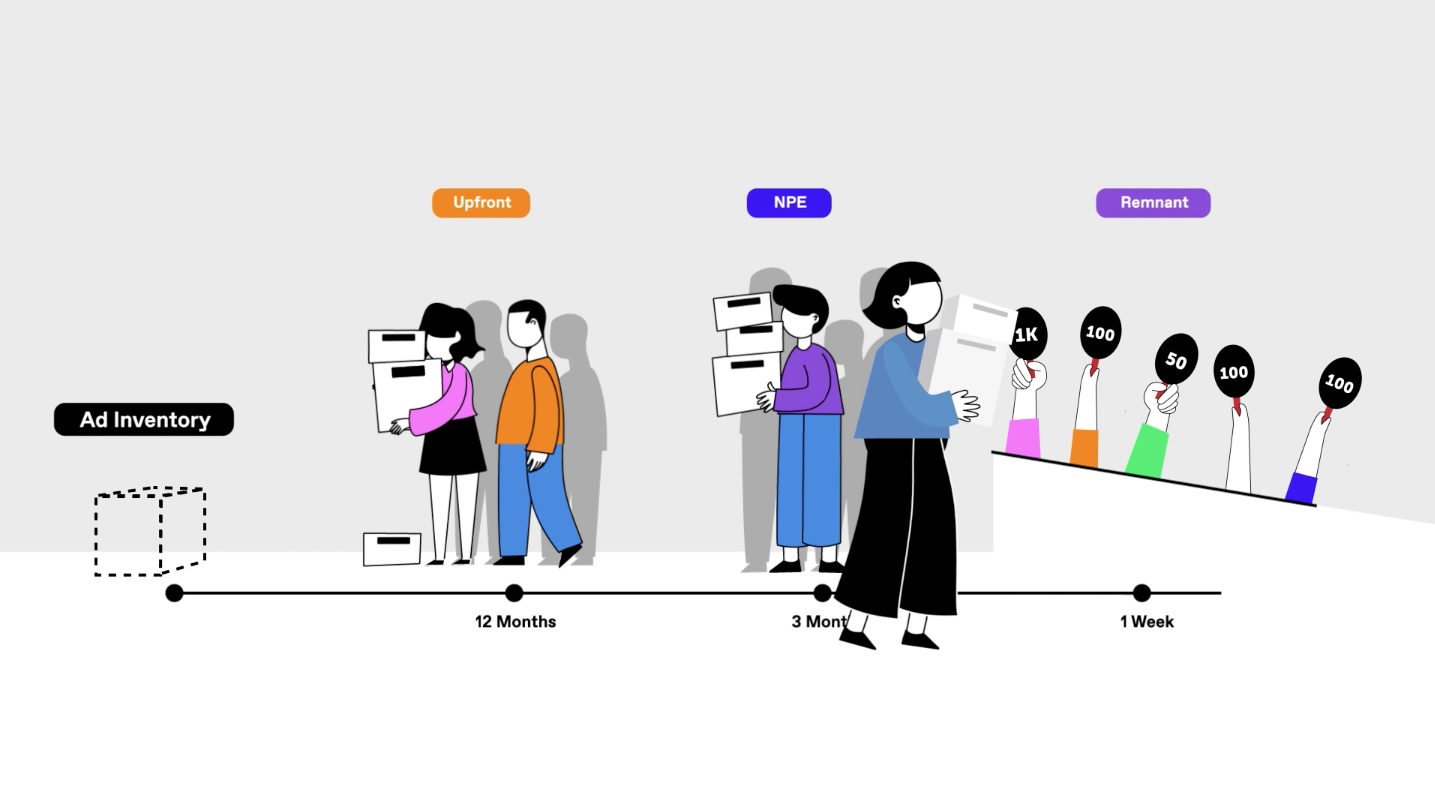

Video: The Basics of Media Buying - TV Inventory

In this video, you’ll learn more about the TV advertising industry, as well as the three types of inventory that Tatari can help secure for your brand.

Read more

What are National-local Spots and Why Should You Test Them?

In this post, we’re doing a deep dive into a complex, yet popular, inventory slice oddly called “national-locals," and sharing how three Tatari clients have leveraged them in their TV ad strategy.

Read more

What’s Driving Down Linear CPMs?

A delve into data and market dynamics that are driving down linear CPMs, and how advertisers can take advantage of them.

Read more