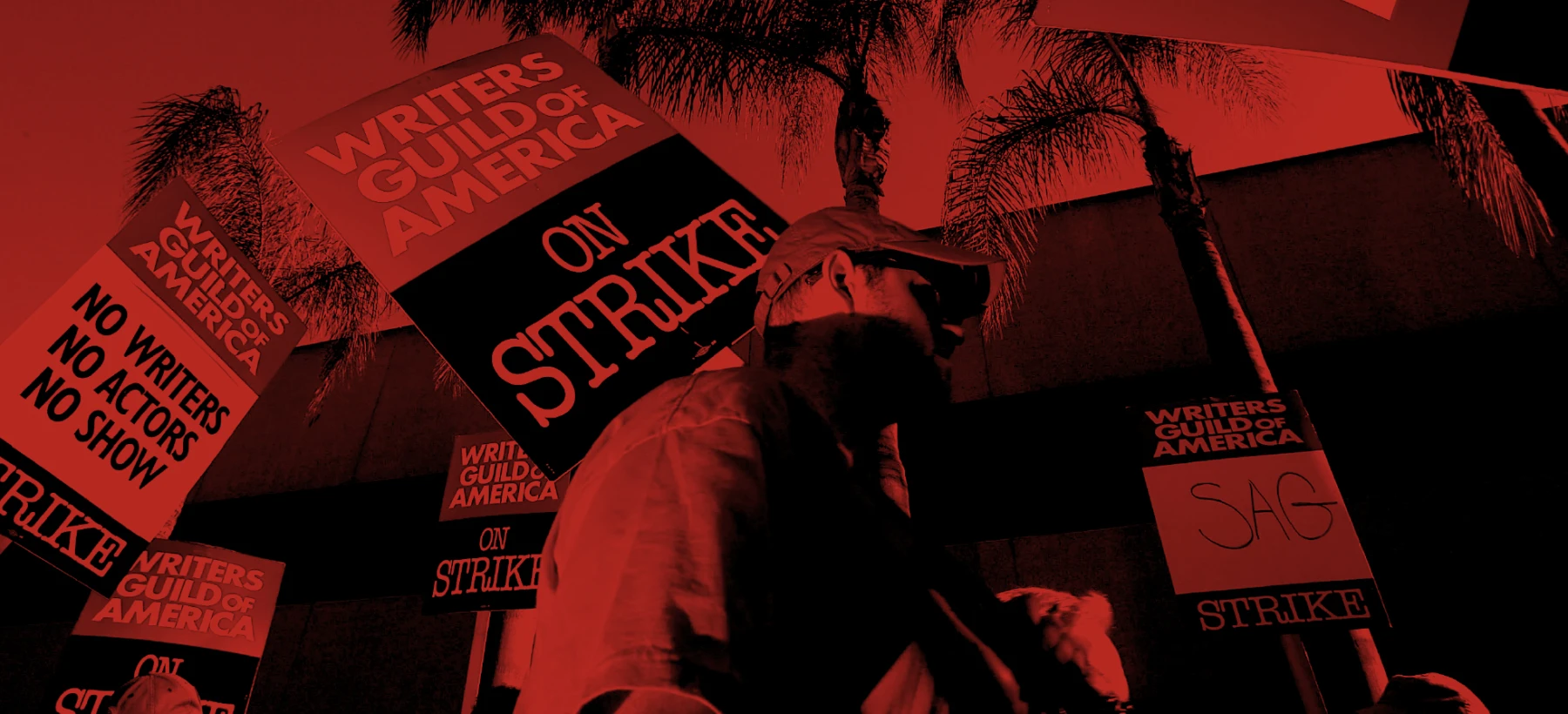

How TV Advertisers Should Prepare for a Lengthy Writers’ and Actors’ Strike

A version of this post was published on AdWeek.

The ongoing WGA and SAG-AFTRA strikes continue to impact the TV ad market, touching everything from active campaigns to Q4 and 2024 planning. With no end in sight, it seems that studios intend to simply ride it out until the writers run out of funds or simply turn to new options like non-unionized content creators and artificial intelligence. At Tatari, we’re planning for all possible outcomes and helping our clients execute high-performing TV campaigns amid the chaos. Here’s what you need to know.

What is at stake?

It’s more than just money. In a very acute manner, writers and actors feel inadequately compensated for their work in the “new” world of streaming TV. In particular, royalties from repeat plays (“residuals”) are counted and structured differently in CTV. In a possibly even more profound way, they are also threatened by the advent of AI. Not only is there a risk that computers will take their job, but also the fact that their old work will not be recognized (or compensated for) when used in training models for AI technology.

Which TV programming is impacted?

The strikes are already impacting the programming that major brands and agencies are negotiating around. Disney has recently paused filming on “Blade” and “Thunderbolts,” while there is a long list of streaming series reportedly experiencing production delays, including “Stranger Things,” “Emily in Paris,” “Hacks,” “Yellowjackets,” “Cobra Kai,” “Unstable,” “Big Mouth,” “The Last of Us," and “Yellowstone.”

With these large marquee titles pausing production, many shows that were set to premiere in Q4 will now premiere in Q1 2024, or scattered later in the year. Large movies from Disney will even move into 2025.

The above list of big-name programs is long, and the total number of affected programs stretches on. Scripted content accounted for 64% of TV and movie content on major streaming platforms in 2022, or nearly two-thirds of all new content for the year.

Streaming TV, however, will be less impacted than linear. Streaming is on-demand and holds huge amounts of old content that viewers can re-watch or discover. Ironically, this may deepen the rift between the opposing parties.

The backup plans for programming

The last strikes date back more than 60 years ago. However, there’s something we can learn from the near past. When production stopped at the height of the Coronavirus pandemic, networks pivoted into news, reality, game shows, and animation to fill airtime. Easy enough.

That’s not the end of it. Studios are sitting on a small arsenal of backup programming: recycled content, UGC creators, and AI.

We’re already seeing networks execute their backup plans as some, like CBS, are putting streaming content (back) on linear TV to fill the gaps. Linear networks with their own ad-supported streaming platforms (NBCU, Disney, Discovery) will also likely push viewers and advertisers toward streaming and its unlimited content libraries.

Beyond that, publishers will find other ways to make content that doesn’t require union work. Netflix’s “Quarterback” is a great recent example of long-form content that didn’t need guild actors or writers to draw viewership. On top of that, there is a vast supply of already-made international content. Netflix (again) has a successful track record of importing these shows to the US audience, with major hits like “Squid Games” and “Money Heist: Korea – Joint Economic Area.” AI makes it easy and cheap for studios to turn a foreign show into its domestic cousin. Therein lies the irony: the strikes, and the longevity of it, reinforce the adoption of AI… which is the root cause of all of this.

And let’s also not dismiss the creator economy. Content from non-unionized YouTube and TikTok creators can move onto TV as networks look for programming. Or worse: accelerate the spread of YouTube and TikTok as fully-fledged television (not social or digital platforms).

How the strikes impact ad inventory

Networks and advertisers don’t know where programming will land, making it very tough to plan for Q4 and beyond. As a result, the Upfronts are moving at a slow pace. The holding companies use the programming slate to project ratings, and the networks use it to project and release costs. General agencies need more confidence to commit, and advertisers will lean into programming that is set, like live sports.

Programming like live sports benefits from the certainty that it will happen as planned, which increases demand. The Super Bowl will have even more importance this year. Advertisers should anticipate increased pricing across all sports and lock in buys as far in advance as possible. This goes beyond marquee sports and even includes programming like the NHL, skiing, snowboarding, and figure skating that will air in the winter.

Brands should secure completed programming set to premiere in the fourth quarter via locked-in buys and sponsorships. This includes the holiday period and the annual events that will not be affected, including Hallmark movies and New Year’s Eve Specials. Increased demand means these programs will get booked faster, and slow-moving advertisers will miss out. More on agility below...

We’ll expect networks to push upfront commitments and the associated audience guarantees into their ad-supported streaming platforms, where there is an unlimited supply of programming. On-demand programming lets viewers access these libraries whenever they want, unbound from a single linear feed. As articulated earlier, overall time spent viewing streaming content will likely increase if there’s a prolonged strike, and Tatari is prepared to guide our clients toward audiences and programming that will drive performance outcomes.

In adversity also lies opportunity, especially for Tatari TV advertisers

Advertisers planning their Q4 TV buys should also anticipate last-minute programming switches like news specials, reruns, and compilations. This creates an advantage for advertisers who are able to move quickly, as last-minute replacement programming often results in fire sales. Advertisers should maintain incremental budgets that they can deploy to capitalize on these opportunities.

It’s worth noting that a similar situation played out in the TV ad market just three years ago, when production shut down amid the early days of the pandemic. Shrewd advertisers worked with Tatari to reach their audiences by adjusting their TV buys.

Like the pandemic, things can change day-to-day as these strikes continue. It’s important for brands to stay up to date on the latest news and keep their ears to the ground. Prolonged production shutdowns don’t benefit any party, so above all, let’s hope things are resolved quickly.

Vicky Chang

I love helping businesses grow.

Related

The Upfronts are Changing: Here’s Everything You Need to Know

As TV continues its massive transition, the Upfronts look and feel a little different each year. At Tatari, we’re here to help our clients navigate the Upfront season while still executing campaigns that drive real-world outcomes and high ROAS.

Read more

Should Brands Advertise on Netflix?

Unlike its streaming rivals, Netflix shares no impressions data with demand-side partners. So, we decided to dig a little deeper into the numbers and explore if there’s still a case to be made for performance-minded TV marketers.

Read more

Market Update: Why Now is the Time to Advertise on TV

When businesses attempt to deal with economic uncertainty, a magnifying glass is often placed on advertising budgets. But as history shows, brands that weather the storm and maintain advertising activity typically fare better than those that pull back.

Read more