The Upfronts are Changing: Here’s Everything You Need to Know

Upfront season is just around the corner. Every year, starting mid-May, networks and agencies begin advertising negotiations for the following broadcast year, with streaming packaged into these deals. This amounts to approximately $20 billion in ad dollars – or roughly a third of the $90+ billion TV space.

This is TV’s version of fashion week, a series of star-studded events that showcase all of the offerings networks will bring to the table for the fall season. In the past, this mostly focused on new shows and returning favorites. Now, networks and media companies showcase their mix of broadcast and streaming offerings, along with network strategies and technological updates.

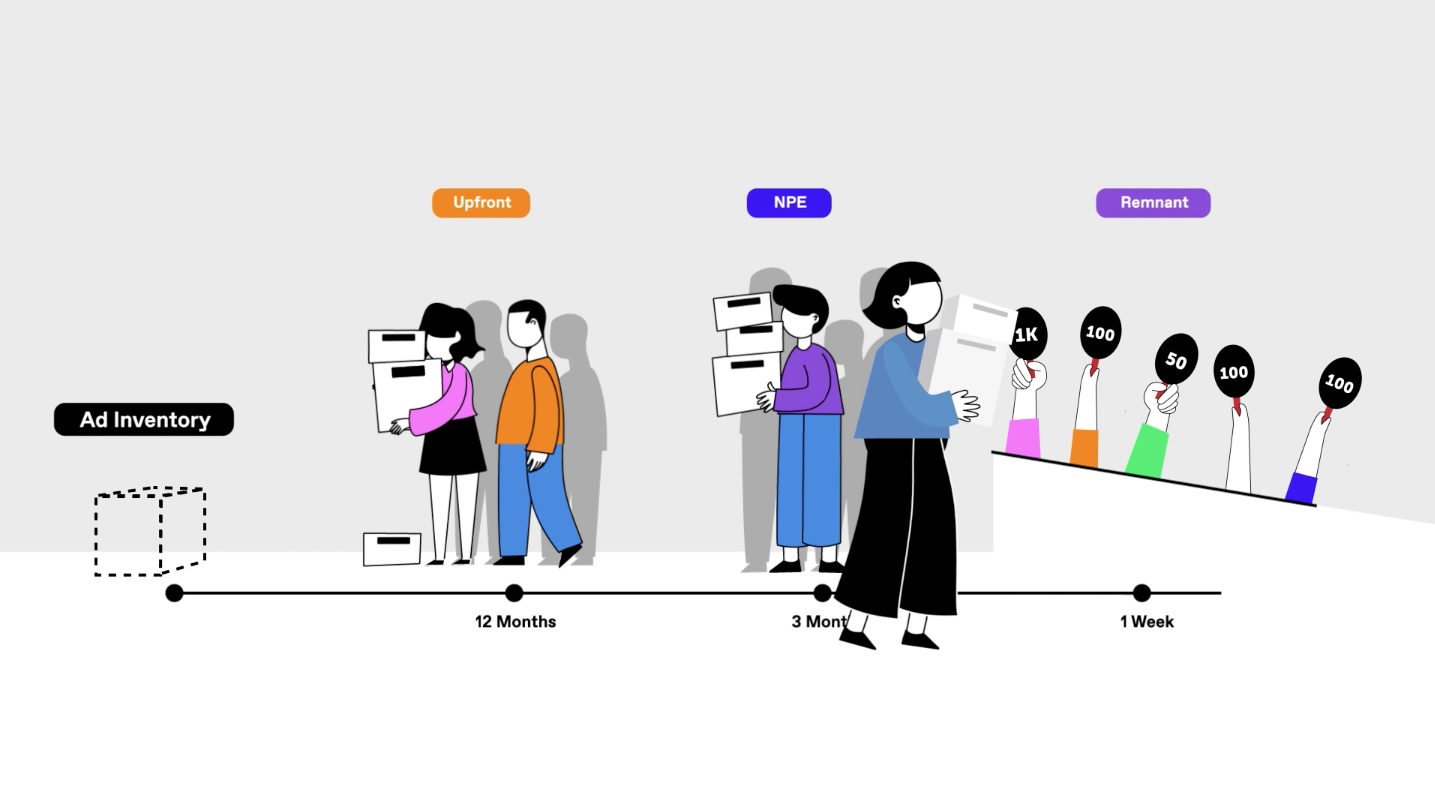

Most brands still commit to full-year buys during the Upfronts, maintaining what they’ve done for decades. Performance marketers – who have mostly done remnant buys with some NPE inventory sprinkled in – may feel that they have no place at the Upfronts, but this is incorrect. (To better understand this post, we recommend you watch our video that explains the three types of inventory in TV media buying.)

As TV continues its massive transition, the Upfronts look and feel a little different each year. At Tatari, we’re here to help our clients navigate the Upfront season while still executing campaigns that drive real-world outcomes and high ROAS.

Curious about the Upfronts and where your brand fits in? Here’s what you need to know.

Upfronts 101

The Upfront calendar gets in motion in early May when the networks run their formal presentations. Even though Upfront buys package in streaming inventory, everything still follows the traditional broadcast calendar, with the new season kicking off in the fall. Many deals wrap in June and July, but brands have until the end of September to close. Closing past July is not recommended, as there is less inventory available. Even with more data-driven buys, major advertisers still lock in their deals before the dog days of summer.

What to know in 2023

It’s become an annual tradition to say the Upfronts are dead, but they evolve and persist. The streaming landscape now accounts for a much larger part of the picture. For example, both Netflix (now that it has an ad offering) and Tubi. Another meaningful change that should be more pronounced in 2023 is a focus on measurement, which has led to more fluidity in deals and more audience-based buying.

A soft marketplace provides opportunities

In a slower economy, the 2023 upfront advertising marketplace will likely be impacted. It is projected that upfront advertising spend for 2023 will decline 7% to 8% from the previous year. The most in-demand premium inventory will still go quickly in Upfront deals; typically about 90% of available inventory in the most popular sports, specials, and first-run originals is sold out by the time the upfront closes. But buyers should leverage current climate conditions in negotiations. More competitive CPMs and flexibility may come with it.

Brand and performance are not mutually exclusive

There is a trend among advertisers to emphasize branding campaigns on TV. This is born out of a digital + performance mindset, although it's important to note that branding fits within the larger performance model. All marketing is performance marketing — in other words, measurable — with brand and direct response meant to complement and act in concert with one another.

Why buy into the Upfronts?

The Upfronts are important for brands that are looking to expand their footprint and raise the ceiling of what they can accomplish with their ad budgets. There are four major reasons why brands and agencies invest:

It’s important to note the scarcity in the market, which is especially true in the world of premium streaming and live, high-profile sporting events. Inventory sold during the upfront includes some of the highest-rated programming on television. Typically about 90% of available inventory in the most popular sports, specials, and first-run originals is sold out by the time the upfront closes.

Deals have never been more diversified

Upfronts are no longer just about linear TV. Whether its run of site or programmatic, streaming is now a critical part of what is negotiated in Upfront deals. In fact, advertisers are planning to allocate 40% of upfront budgets to CTV. Brands looking for reach across channels should be happy to know that the networks are responding to their demands, packaging multiple assets to deliver impressions. Brands should look to maximize what these deals can accomplish and negotiate for the most reach based on their marketing calendar for the year ahead. Here’s what an Upfront package could look like:

Upfront Buys offer incremental reach

Upfront buys provide significant incremental reach above remnant alone, because it includes a significant broadcast portion. Cable viewership has diminished since its COVID peaks, while broadcast reach remains steady because of the live element and sports programming.

We worked with a brand that was able to achieve an average of a 7% additional monthly reach solely via upfronts on broadcast over a three month period. While the percentages may not seem like much, they equated to an extra 3.5 million households that would not have otherwise been exposed to the brand's message, despite a heavy remnant linear budget.

Impression guarantees provide security

If brands know that there are time periods in the year ahead that are a priority, then waiting to find incremental reach in the scatter market can be a risky proposition. Scatter buys offer less lead time and a narrower choice of inventory — typically with less leverage.

Impression guarantees are one of the advantages of the Upfronts, as they protect against under-delivery. Our perspective is that the Upfronts provide the best chance of beating out the quoted CPM of a network due to the ability to pick and choose the inventory you want to be in.

If that inventory over-delivers, advertisers have beat out the CPM. If the inventory under-delivers, the other positive impact is that make-goods (also known as audience deficiency units, or ADUs) are delivered throughout the quarter to meet expectations for a particular package.

Finally, understand that firesales and Upfronts are complementary, not an either/or situation. Rest assured that Tatari will continue to flag low rates and areas of opportunity to brands, but Upfronts add a layer of predictability and audience guarantees.

Flexibility is still available

While Upfront buys aren’t as flexible as the scatter market (also known as remnant), they are also not set in stone. If plans change, brands still need to pay for at least a portion of the operation, but some inventory can be canceled through negotiated options. Given the soft market we’re seeing right now, we expect that flexibility to remain.

It’s also important to note that Upfront buys aren’t a lock-in for the entire year. Brands can pick the quarters they want to advertise within while skipping others.

Expectations for the Upfronts

When planning an Upfront buy, brands need to ask three critical questions:

Who is your audience?

What is your seasonality?

What is your budget?

Brands should also understand that investment in the Upfronts is critical for long-term growth. There is an incorrect belief that performance and branding campaigns are separate components of a marketing strategy. Instead, brands should view both direct response and brand marketing tactics as part of a larger performance strategy, and both should be informed by measurement insights.

Upfront buys executed with Tatari will still include the kind of measurement that brands expect, with added quarterly reporting on metrics like conversion volume, conversion rate, and baseline lifts. TV is a long-term channel, but we’ll provide up-to-date analysis on what inventory is moving the needle and use that information to inform how to optimize the plan in real-time, or for the following Upfront year.

What’s next?

If you’re interested in pursuing an Upfront strategy in 2023, now is the time to start talking to your Tatari account manager to align on approach and budgets. Registration deadlines are in May, and negotiations kick off in the same month.

Andrew Cunningham

I’m a strategist in pursuit of a crossword time to rival my mile time.

Related

Video: The Basics of Media Buying - TV Inventory

In this video, you’ll learn more about the TV advertising industry, as well as the three types of inventory that Tatari can help secure for your brand.

Read more

Adding Brand Objectives to a Performance-Focused TV Ad Strategy

Let’s take a look at how three Tatari clients, Nutrafol, Tecovas, and Ro, started their TV journey with a performance-focused mindset and later added brand objectives to drive even stronger campaign results.

Read more

Should Brands Advertise on Netflix?

Unlike its streaming rivals, Netflix shares no impressions data with demand-side partners. So, we decided to dig a little deeper into the numbers and explore if there’s still a case to be made for performance-minded TV marketers.

Read more